This past summer, the smoke traveling south from Canadian wildfires caused air quality to go down significantly where I live, on the East Coast, for a day or two. Still, as Bjorn Lomborg writes in the Wall Street Journal:

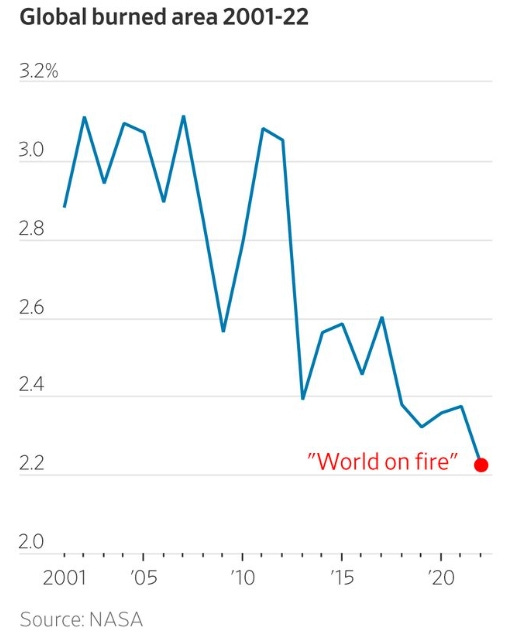

One of the most common tropes in our increasingly alarmist climate debate is that global warming has set the world on fire. But it hasn’t. For more than two decades, satellites have recorded fires across the planet’s surface. The data are unequivocal: Since the early 2000s, when 3% of the world’s land caught fire, the area burned annually has trended downward. In 2022, the last year for which there are complete data, the world hit a new record-low of 2.2% burned area. Yet you’ll struggle to find that reported anywhere … [T]he latest report by the United Nations’ climate panel doesn’t attribute the area burned globally by wildfires to climate change. Instead, it vaguely suggests the weather conditions that promote wildfires are becoming more common in some places. Still, the report finds that the change in these weather conditions won’t be detectable above the natural noise even by the end of the century … While the complete data aren’t in for 2023, global tracking up to July 29 by the Global Wildfire Information System shows that more land has burned in the Americas than usual. But much of the rest of the world has seen lower burning—Africa and especially Europe. Globally, the GWIS shows that burned area is slightly below the average between 2012 and 2022, a period that already saw some of the lowest rates of burned area … It’s embarrassingly wrong to claim, as climate scientist Michael Mann did recently, that climate policy is the “only way” to reduce fires. Prescribed burning, improved zoning and enhanced land management are much faster, more effective and cheaper solutions for fires than climate policy.

Of course, fires will continue to occur, but with many varied causes. As the Wall Street Journal wrote in August, 2023:

The deadly fires in Maui last week are still being investigated, and there may have been more than one contributor. But one culprit that seems to be emerging is the tradeoff the local utility had to navigate between power grid safety and the government-mandated green energy transition. Video footage points to fallen power lines as a possible cause of the deadly fires … If Hawaiian Electric’s lines did ignite the fires, it would echo the problems of PG&E, the California utility that filed for Chapter 11 bankruptcy in 2019 after getting sued for tens of billions of dollars for damages from fires caused by its equipment. The 2018 Camp Fire killed 84 people and razed the town of Paradise. What both utilities have in common is that they prioritized growing renewable power to meet government mandates over hardening their systems and reducing fire risk. In 2015 Hawaii lawmakers required that 100% of the state’s electricity come from renewable sources by 2045. California and some other states followed with similar mandates. Hawaii’s mandate was an especially tall order since only about 20% of its power in 2015 came from renewables … To meet the government mandate, Hawaiian Electric embarked on a rapid renewable build-out, which involved heavily subsidizing rooftop solar and batteries and contracting for large-scale renewables at elevated prices … Every dollar the utility spent on subsidizing solar and connecting renewables to the grid was one less dollar available for strengthening equipment and removing combustible brush … A fraying electric grid is a nationwide problem. Consultants at Marsh McLennan estimate that more than $700 billion will need to be spent to replace aging transmission lines and maintain grid reliability. Sixty percent of U.S. distribution lines have surpassed their 50-year life expectancy. The average age of large power transformers is 40 years, twice their planned life span.

In previous essays, we explored how policies limiting the use of fossil fuels are based on significant mismeasurements of the scope of the problem and the impact various “climate change” mitigation programs would have on society. Such mismeasurements are proceeding apace. As the Wall Street Journal wrote in August, 2023:

The Administration is spending literally trillions of dollars in taxpayer subsidies and calling the projects that result an economic miracle. But government can always get more of what it subsidizes, and in this case it’s a gusher on politically favored industries … The really big hitter is the Inflation Reduction Act (IRA), which includes $1.2 trillion in climate spending and tax credits over the next decade and another $400 billion in government loans. Apart from wartime, we doubt there has ever been a bigger splurge of government subsidies. All of this inevitably produces a surge in investment, at least in the short term. GDP will see a boost, much as it did from the welfare payments during the pandemic. But the test of all this spending isn’t the number of new projects that break ground. It’s whether those projects will be more productive than those that would otherwise have gone ahead if government hadn’t directed the capital … The IRA’s $1.2 trillion in climate subsidies will invariably cause investment distortions and unseen economic damage. As 19th-century French economist Frédéric Bastiat explained, economic meddling produces effects that can be immediately seen—such as new factories—as well as harm that isn’t visible. The IRA’s climate subsidies are so large that companies almost have to grab them, lest competitors get an edge … Most of these green-energy investments wouldn’t be happening if not for subsidies.

As William Beach writes in the Coolidge Review, the first era of rapid technological change for the better that occurred a century ago happened in the absence of government regulation:

At the beginning of the 1920s, about 30 percent of American homes had electricity. By the end of the decade, nearly 70 percent had been electrified … Electricity improved during that time, too, as alternating current, or AC, became standardized. With that came electric lights instead of kerosene lamps, and electric appliances such as the iron, the toaster, the washing machine, and the vacuum cleaner. Electricity revolutionized home life, removing much of the drudgery. Electricity changed the economy as well. In 1914, only 30 percent of manufacturing was electrified; by 1929, that number had reached 70 percent. How did electricity get to homes and factories? Was there a big federal program to build the massive infrastructure of power stations and wires needed? No, private utilities built it. In 1920, 20 percent of people had automobiles; by 1929, 60 percent of families owned cars. There were 9 vehicles for every 10 households. The automobile revolution happened in one decade … The transportation revolution didn’t occur because the federal government offered tax breaks and subsidies. There was no federal spending bill to build the network of gas stations motorists needed. No, the filling stations came in on their own when people figured out that they could make money operating them … Average earnings rose 30 percent in a decade. Gross domestic product (GDP) rose by a third... This great economic and lifestyle revolution for Americans of modest means happened with basically no guidance from the federal government. The government largely stayed out of the way. And the government did not try to regulate improvement in the name of “equity.” Is it terrible that rich people got to buy a Model T Ford in 1924 and poorer people waited until 1927 to buy one at half the price? Would we look back and wish the government had slowed it all down in the name of equity?

This summer, at a science conference in Korea, Dr. John F. Clauser, joint recipient of last year’s Nobel Prize in Physics, told his fellow scientists: “There is no real climate crisis … Regarding climate change, the predominate process I believe has been misidentified by a factor of 200.” And as explored in a previous essay, none of the most dire predictions of the effects of “climate change” even account for the ability of fossil fuels themselves to mitigate potential negative consequences. If one reads carefully, as some have, even prominent proponents of “climate change” mitigation policies at times admit there is much less cause for alarm than commonly expressed in press releases. As Steven Koonin writes in the Wall Street Journal:

The journalist Michael Kinsley famously noted that “a gaffe is when a politician tells the truth.” By that standard, the White House committed a doozy in March when it released a paper on climate change’s effect on the U.S. economy. Its findings undermine any claims of an ongoing climate crisis or imminent catastrophe. The report, produced by the Council of Economic Advisers and the Office of Management and Budget, assesses how the economic consequences of climate change could be integrated into federal budgeting. The report’s first figure—reproduced nearby—shows 12 independent peer-reviewed estimates of how America’s gross domestic product would decline as the global temperature rises. While the estimates differ, each shows an economic impact of less than a few percentage points for a few degrees of warming. The consensus, apart from two counterbalancing outliers, is that today’s warming of 2.2 degrees Fahrenheit has reduced GDP by less than 0.5%. That is trivial, considering real GDP has grown by more than 800% since 1950. If warming reaches 4.5 degrees—about what the United Nation’s climate panel projects for 2100 under plausible scenarios for future global emissions—the consensus reduction amounts to less than 2%. In other words, if the average annual GDP growth rate is 1.5% for the next 80 years, the economy would grow 232%. A 2% climate-change effect would reduce that growth to 225%. As physicists say, that’s a difference “in the noise.” … [C]ritically, the report also omits America’s amazing capacity to adapt, if not thrive, under a changing climate. The U.S., excluding Alaska and Hawaii, has warmed about 2 degrees Fahrenheit since 1901. Despite that warming, the nation has flourished: Its population has quadrupled, its average life expectancy soared, to 79 years from 48, and its economic activity per capita multiplied around sevenfold.

And as Bjorn Lomborg writes:

Top administration officials are fanning out across the U.S. in a victory lap for the new Inflation Reduction Act, which President Biden calls “the most significant legislation in history to tackle the climate crisis.” America, we are told, is a global climate leader again. This narrative has serious problems … While the administration talks up its emission reductions, it never seems to tout the law’s impact on temperature and sea level—for good reason. If you plug the predicted emissions decline into the climate model used for all major United Nations climate reports, it turns out the global temperature will be cut by only 0.0009 degree Fahrenheit by the end of the century. This is assuming the law’s emission reductions end when its funding does after 2030. But even if you charitably assume they’ll somehow be sustained through 2100 without any interruption, the impact on global temperature will still be almost unnoticeable, at 0.028 degree Fahrenheit. The law will similarly have little effect on the sea level. A model that calculates changes in ocean levels predicts waters will be somewhere between 0.006 and 0.08 inch lower in 2100 than they would have been without the Inflation Reduction Act … The cost of the act also belies the oft-repeated claim that green technologies are already cheaper than fossil-fuel alternatives. If they were, they wouldn’t need enormous subsidies. If green energy is going to work, it needs to be as reliable and cheap as fossil fuels.

As Benjamin Zycher points out, “Net-zero U.S. GHG [greenhouse gas] emissions effective immediately would yield a reduction in global temperatures of 0.173°C by 2100. That effect would be barely detectable given the standard deviation (about 0.11°C) of the surface temperature record.” Indeed, natural phenomena can often wipe out decades’ worth of government-required reductions in carbon emissions. As the Wall Street Journal points out:

Two decades of greenhouse gas emission reductions in California went up in smoke in 2020—literally. So finds a new study on Golden State wildfire emissions that highlights the folly of Sacramento’s climate priorities. University of California researchers calculated that wildfire emissions in 2020 alone were two times higher than the state’s greenhouse gas reductions from 2003 to 2019. That’s in a single year. Incredibly, wildfires in 2020 were the state’s second largest source of CO2 emissions after transportation and generated double the greenhouse gases of all the state’s power plants. While vegetation will regrow and suck carbon out of the air, the study says “this is unlikely to occur on the time scale necessary to meet near and medium-term emission targets needed to avert passing the 1.5 degree C threshold” by 2050. So thanks to California, the world is doomed. Or so liberals say if the 1.5 degree warming threshold that is supposed to signal climate Armageddon is exceeded … [T]he study also notes, much of the blame goes to “decades of fire suppression and underinvestment in preventive measures such as mechanical clearing or prescribed burns.” “Wildfire emissions have not received nearly the same level of societal investment or attention as emissions from other sectors,” the authors note. The state focuses on a futile effort to stop temperatures from rising instead of doing what is achievable and mitigating the impact from whatever warming does occur … While utilities rushed to meet state renewable energy mandates—one reason California’s electric rates are double those in neighboring states—tree-trimming and burying power lines were a low priority.

While it remains the case that many people fail to understand the crucial role fossil fuels play in maintaining the electricity grid that powers human well-being (as explored in a previous essay series), governments will continue to enact policies that promote vastly less efficient alternatives. As the Wall Street Journal writes:

The warnings keep coming that the force-fed energy transition to renewable fuels is destabilizing the U.S. electric grid, but is anyone in government paying attention? Another S.O.S. came Friday in an ominous report from PJM Interconnection, one of the nation’s largest grid operators. The PJM report forecasts power supply and demand through 2030 across the 13 eastern states in its territory covering 65 million people. Its top-line conclusion: Fossil-fuel power plants are retiring much faster than renewable sources are getting developed, which could lead to energy “imbalances.” That’s a delicate way of saying that you can expect shortages and blackouts … [I]t’s especially worrisome that PJM is predicting a large decline in its power reserves as coal and natural-gas plants retire. The report forecasts that 40,000 megawatts (MW) of power generation—enough to light up 30 million households—are at risk of retiring by 2030, representing about 21% of PJM’s current generation capacity. Most projected power-plant retirements are “policy-driven,” the report says. For example, the steep costs of complying with Environmental Protection Agency regulations … At the same time, utility-company ESG (environmental, social and governance) commitments are driving coal plants to close, the report notes.

And while nuclear energy remains the safest route toward lower carbon emissions (as explored in a previous essay), as the Wall Street Journal writes:

With a stroke of his pen, President Biden on Tuesday walled off from development nearly a million acres of land that includes some of America’s richest uranium deposits. This is another monument to the Administration’s destructive energy policy. The Antiquities Act of 1906 lets Presidents set aside federal land for national monuments to protect historic objects. Barack Obama used the law to remove millions of acres of federal land from oil and gas development. Yet even he resisted progressive calls to set aside uranium-rich land outside the Grand Canyon. Mr. Biden shows no such restraint. On Tuesday he declared a national monument on 1,562 square miles in Arizona called Baaj Nwaavjo I’tah Kukveni, meaning “where tribes roam.” The monument will conserve “landscape sacred to Tribal Nations and Indigenous peoples and advance President Biden’s historic climate and conservation agenda,” the White House says. The statement omits that the land also includes America’s only source of high-grade uranium ore that is economically competitive on the global market. The U.S. imports about 95% of uranium used for nuclear power reactors, mostly from Kazakhstan, Canada, Russia and Australia. Russia is the U.S.’s third biggest uranium source … Tribes claim that uranium mining could contaminate water and wildlife. But a U.S. Geological Survey in 2021 found springs and wells in the region met federal drinking-water standards despite decades of uranium mining.

But perhaps the tide is turning. One prominent perpetrator of a massive financial deception admitted he promoted “carbon neutral” policies not because they are prudent, but because those promotions pleased “progressive” politicians and detracted attention from his fraudulent schemes. As the Wall Street Journal writes:

Crypto dark knight Sam Bankman-Fried may have deceived investors, customers and various journalists and politicians. But now the FTX founder is at least telling the truth about a few things. Lo, he says that environmental, social and governance (ESG) investing is a fraud, and so was his progressive public posturing. Mr. Bankman-Fried on Wednesday tweeted a rambling account attempting to explain how he managed to lose billions of dollars in FTX customer funds … Mr. Bankman-Fried virtue-signaled by committing to make FTX “carbon neutral” and donating generously to fashionable progressive causes such as a foundation working to provide solar energy in the Amazon River basin … Meanwhile, he was leveraging FTX customer funds to make risky, ill-timed bets … Mr. Bankman-Fried is also acknowledging that he genuflected to regulators and Democratic lawmakers to win political protection. ESG ratings company Truvalue Labs even gave FTX a higher score on “leadership and governance” than Exxon Mobil, though the crypto exchange had only three directors on its board … “ESG has been perverted beyond recognition,” Mr. Bankman-Fried confessed in an interview this week with Vox in which he also acknowledged that his advocacy for strong crypto regulations was “just PR.” He said he feels “bad for those who get” harmed by “this dumb game we woke westerners play where we say all the right shiboleths [sic] and so everyone likes us.” Ah, yes, the poor saps who invest in companies because they claim to be sustainable.

And more and more legitimate private investment entities are dropping their own previous adherence to similarly imprudent policies. As Terrence Keeley writes:

Vanguard’s Tim Buckley is having a Copernican moment. Like the famous Renaissance polymath who challenged conventional wisdom about celestial movement, the 54-year-old CEO is challenging the asset-management industry’s environmental, social and governance orthodoxy. “Our research indicates that ESG investing does not have any advantage over broad-based investing,” Mr. Buckley said in a recent interview with the Financial Times. Matching word to deed, his comments came after he had withdrawn his firm from the $59 trillion Net Zero Asset Managers initiative, an organization that is part of the $150 trillion United Nations-affiliated Glasgow Financial Alliance for Net Zero. Both alliances are committed to restricting their investments over time to companies that are compliant with the Paris Agreement’s objective of net-zero greenhouse gas emissions by 2050. Mr. Buckley claims the financial world, swept up in climate-change fervor, can’t make such commitments without reneging on its fiduciary duties … Mr. Buckley effectively claims that ESG managers are playing the fool and taking their clients’ money with them. Fewer than 1 in 7 active equity managers outperform the broad market in any five-year period. Over the past five years, not one relied exclusively on a net-zero investment methodology. Outperforming the market is even more difficult over longer time horizons—only 1 in 10 over 10 years, and 1 in 20 over 20 years, ever do. Last year, tech stocks fell by more than 30% while the energy sector, including oil and gas firms, gained nearly 60%. Yet because of their net-zero pledge, ESG funds continue to overweight the former and underweight the latter … Mr. Buckley also knows that Vanguard can’t promise to be a fiduciary to its clients while also committing to align its assets with the 2050 net-zero target.

And regarding the real-world costs of “green energy,” as the Wall Street Journal notes:

The International Energy Agency said this week that 49.7 million miles of transmission lines—enough to wrap around the planet 2,000 times—will have to be built or replaced by 2040 to achieve the climate lobby’s net-zero emissions goal. This amounts to a plan for everyone to buy more metals from coal-fired plants in China. Grid investment, the IEA report argues, is needed to carry additional renewable energy “as the world deploys more electric vehicles, installs more electric heating and cooling systems, and scales up hydrogen production using electrolysis.” By its estimate, the world needs to spend $600 billion annually on grid upgrades by 2030. Unlike fossil fuel and nuclear power plants, solar and wind projects are typically many miles from population centers. That means long transmission lines, some under the sea to take electricity from off-shore wind installations. Tens of thousands of extra power transformers will be needed to step up and down voltage. All of this would cost trillions of dollars and require enormous quantities of metals. “Copper and aluminium are the principal materials for the manufacture of cables and lines,” the IEA report says. Transmission lines also need insulators, such as cross-linked polyethylene and ethylene-propylene polymer—both derived from fossil fuels … Where are the materials going to come from? The report doesn’t say, but the most likely answer is China, which dominates global copper, steel and aluminum production, owing to its lax environmental regulation and low labor costs. Over the past 20 years, primary aluminum production has increased ninefold in China while declining 68% in the U.S. Metals manufacturing takes massive amounts of power, and coal accounts for 60% of China’s electric generation. In other words, the IEA’s path to a net-zero grid would involve emitting a lot more CO2 …

As Bjorn Lomborg writes in the Wall Street Journal, the much higher costs of “green energy” are hidden in the U.S. by subsidies:

The claim that green energy is cheaper relies on bogus math that measures the cost of electricity only when the sun is shining and the wind is blowing. Modern societies need around-the-clock power, requiring backup, often powered by fossil fuels. That means we’re paying for two power systems: renewables and backup. Moreover, as fossil fuels are used less, those power sources need to earn their capital costs back in fewer hours, leading to even more expensive power. This means the real energy costs of solar and wind are far higher than what green campaigners claim. One study shows that in China the real cost of solar power on average is twice as high as that of coal. Similarly, a peer-reviewed study of Germany and Texas shows that solar and wind are many times more expensive than fossil fuels. Germany, the U.K., Spain, and Denmark, all of which increasingly rely on solar and wind power, have some of the world’s most expensive electricity. The International Energy Agency’s latest data (from 2022) on solar and wind power generation costs and consumption across nearly 70 countries shows a clear correlation between more solar and wind and higher average household and industry energy prices. In a country with little or no solar and wind, the average electricity cost is about 12 cents a kilowatt-hour (in today’s money). For every 10% increase in solar and wind share, the electricity cost increases by more than 5 cents a kilowatt-hour. This isn’t an outlier; these results are substantially similar to 2019, before the effects of the pandemic and the war in Ukraine.

At least climate-obsessed European governments are generally honest about solar and wind costs and raise electricity prices accordingly, making consumers bear the weight of green energy policies directly. In the U.S., by contrast, consumers pay solar and wind costs indirectly—through tax deductions and subsidies. Solar and wind credits cost the federal government more than $20 billion in 2024, supplemented by state subsidies. Texas received about $2 billion in federal subsidies last year, and state government subsidies at least tripled that cost. This suggests a total hidden cost for the entire U.S. that perhaps runs more than $60 billion annually, implying that the actual cost of electricity with solar and wind is far higher than stated prices.

And as Bjorn Lomborg reports in November, 2023:

A new special issue of the journal Climate Change Economics contains two ground-breaking economic analyses of policies to hold global temperatures to 1.5 degrees and its practical political interpretation, mandates to reach net zero, usually by 2050. Though more than 130 countries, including most of the globe’s big emitters, have passed or are considering laws mandating net-zero carbon emissions, there’s been no comprehensive cost-benefit evaluation of that policy—until now. One of the Climate Change Economics papers is authored by Richard Tol, one of the world’s most-cited climate economists. He calculates the benefits of climate policy using a meta-analysis of 39 papers with 61 published estimates of total climate change damage in economic terms. Across all this, Mr. Tol finds that if the world meets its 1.5 degree promise, it would prevent a less than 0.5% loss in annual global domestic product by 2050 and a 3.1% loss by 2100. If that sounds underwhelming, blame one-sided reporting on climate issues. While headlines tend to focus on stories of violent climate catastrophes and modeled worst case scenarios, the data reveal a far less frightening picture. Despite a drumbeat of stories this summer about rising heat deaths, higher temperatures also prevent cold deaths, and so far in much greater number. Globally, the result has been fewer overall temperature-related fatalities. Writ large, the damage the world experiences each year from climate-related disasters is shrinking, both as expressed in fraction of GDP and lives lost. While media coverage tends to hype the benefits of climate policy, it plays down the costs, which Mr. Tol’s analysis shows are substantial. Based on the latest cost estimates of emission reductions from the United Nations climate panel, he finds that fully delivering on the 1.5-degree Paris promise will cost 4.5% of global GDP each year by midcentury and 5.5% by 2100. This means that likely climate policy costs will be much higher than the likely benefits for every year throughout this century and into the next. Under any realistic assumptions, the Paris agreement fails a basic cost-benefit test. The reality would likely be worse than Mr. Tol’s estimate. He unrealistically assumes governments will implement policies that meet these temperature targets at the lowest possible cost, such as a globally uniform, increasing carbon tax. In real life, climate policy has been needlessly expensive, with a plethora of inefficient, disconnected measures such as electric-vehicle subsidies. Studies show that the policies actually being enacted to curb carbon emissions will cost more than twice the theoretical expense Mr. Tol outlines. This is borne out in the second Climate Change Economics study. The peer-reviewed paper from MIT economists identifies the cost of holding the temperature’s rise below 1.5 degrees as well as that of achieving net zero globally by 2050. The researchers find that these Paris policies would cost 8% to 18% of annual GDP by 2050 and 11% to 13% annually by 2100 … Averaged across the century, delivering the Paris climate promises would create benefits worth $4.5 trillion (in 2023 dollars) annually. That’s dramatically smaller than the $27 trillion annual cost that Paris promises would incur, as derived from averaging the three cost estimates from the two Climate Change Economics papers through 2100.

This concludes this series of essays updating topics previously explored.

Paul, Always glad to see that there may be hope and that not everyone is supremely stupid (excepting those in government where there appear to be no exceptions). I never read one of your pieces without learning a great deal. That is really hard to pull off. Thanks for continuing on this mission.