Over the last couple years, federal spending has far exceeded historical norms. President Biden’s March 2021 $1.9 trillion American Rescue Plan was characterized by President Obama’s former Treasury Secretary Larry Summers as the most irresponsible budget policy measure in the past forty years. Since then, as the Wall Street Journal points out:

The nearby table shows how far the Biden revenue and outlay numbers exceed the U.S. historical norm. Revenues last year hit 19.6% of GDP, far above the 17.4% average over the last 50 years, and a share of the economy reached only in 1944, 1945 and 2000. The overall federal tax burden is higher than ever, and the American taxpayer is paying more than his fair share. Now look at the spending side of the ledger. Outlays reached 24.8% of GDP last year, far above the 21% 50-year average. Under current law, that spending burden will continue with some modest annual changes more or less through 2033 … Meanwhile, so-called mandatory spending for entitlements (Social Security, Medicare and more) hit a new peak of 16.3% of GDP last year, far above the 10.9% average. That will fall slightly as pandemic programs end, but it will accelerate again later in this decade as more of the baby boomers retire. And don’t forget interest on the federal debt, which is rising fast again as the Federal Reserve raises interest rates to normal levels. CBO estimates that interest payments will gobble up 3.6% of GDP in a decade, which is based on optimistic assumptions about inflation and rates.

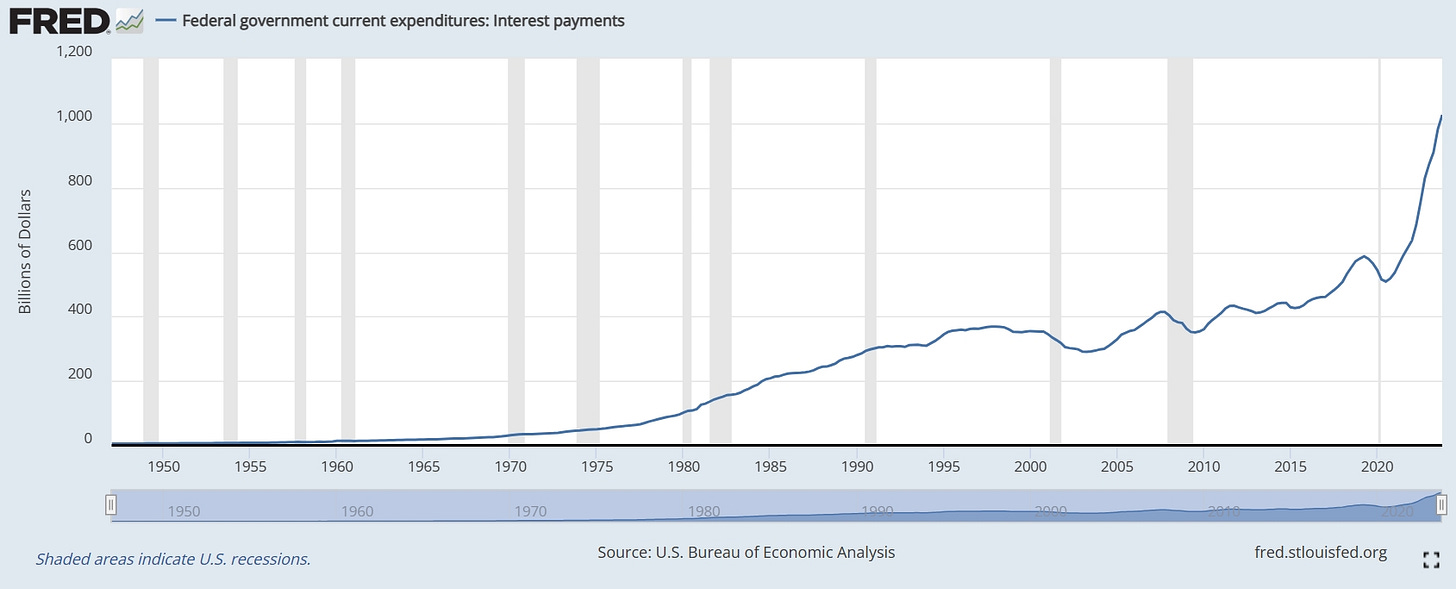

As of April, 2024, the interest paid by taxpayers on the federal debt exceeded a trillion dollars.

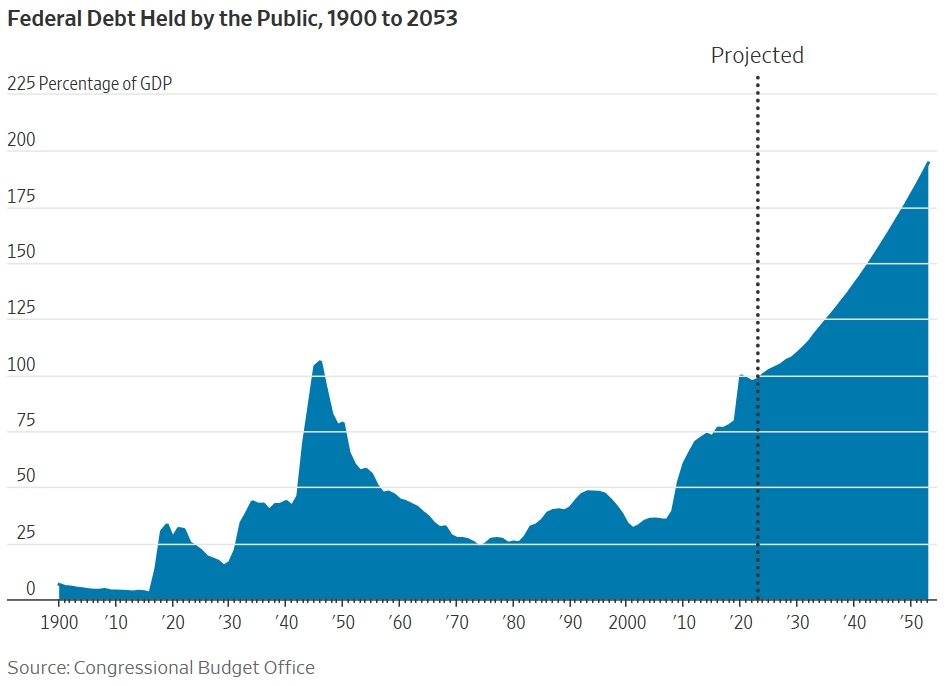

Regarding the federal debt:

[T]he nearby chart shows how fast it has grown in the last several years. Debt held by the public—the kind we have to pay back to creditors like the Chinese and Japanese based on contracts—is now 97% of the economy, and will soon rise to 100% and keep going to 118.2% in 2033. How high can it go before creditors stop lending? No one knows, but it will be ugly if they do.

As Grover Norquist writes in the Wall Street Journal:

[From 2013 to 2022] [h]ad the federal government limited the growth in spending to a maximum of the population growth rate plus inflation during that decade, in 2022 the federal government would have spent $1.6 trillion less than it did, resulting in at least a $200 billion surplus. If the federal government had done this over the past two decades, the national debt would have increased by less than $500 billion instead of $19 trillion.

James Freeman of the Wall Street Journal quotes Jason DeSena Trennert of Strategas, who describes the following state of the federal debt in a note to clients:

It took Uncle Sam 232 years to accumulate its first $10 trillion in debt, nine years to accumulate its second, and five years to reach its third. The trip from $33 trillion to $34 trillion in debt was a short one, requiring only three months, from September to December of 2023 … If having $34 trillion in debt wasn’t enough, the Treasury department funded itself with short-term debt at a time of secularly low interest rates. More than one-third of America’s debt matures in the next year, resetting at higher rates and increasing the debt load by higher interest expenses alone.

U.S. federal profligacy has now exceeded that of Europe. As the Wall Street Journal reports, “In projections released earlier this month, the International Monetary Fund projects U.S. deficits for all governments will reach 7.4% of GDP in 2024 and 2025. But in Europe it is a different picture. The IMF expects combined deficits of eurozone governments will fall to 3.4% of GDP this year from 3.6% in 2022, and further to 2.7% in 2024.”

The Congressional Budget Office recently described how one particular budget category in Washington is going through the roof. As the Wall Street Journal points out:

The big news in the budget details [from the Congressional Budget Office’s analysis of the federal budget for fiscal year 2023] is that payments on federal debt are soaring as interest rates rise. CBO says interest payments have climbed $149 billion in the first 11 months of the fiscal year to $644 billion, up 30% from last year. Debt payments are getting close to spending on national defense of $692 billion, if you can believe it. A third of the current deficit is going to pay interest on money borrowed for previous spending blowouts.

Researchers at the American Enterprise Institute used additional information to make the following national debt calculations:

Within the next ten years, we find the federal government budget deficit relative to national income will grow significantly beyond historical experience and may be regarded as unsustainable. We project that debt-to-GDP will be 134 percent in 2032 and 263 percent in 2052, compared to CBO’s 115 percent and 189 percent, respectively. Real interest rates rise in the long run in a ratcheting cycle of higher interest payments and growing deficits and debt. Our projection of national health expenditures relative to GDP in 2072 is 29.6 percent, compared to 28.4 percent by the Centers for Medicare & Medicaid Services (CMS), used by the Medicare Trustees.

As the Wall Street Journal summarized the situation in August, 2023:

What’s astounding is that this Beltway blowout is happening when the economy is growing, the Covid crisis is past, and there are no domestic emergencies to address. This is when deficits are supposed to decline, as they did during the economic expansions of the 1980s, 1990s and 2000s. Deficits also fell under President Obama after Republicans regained control of the House in 2010. CBO lays out the gory details. Revenues have fallen about 10%, despite the Democrats’ increase in corporate taxes. Individual income-tax revenue is down 20%, or about $442 billion, and CBO speculates one reason is smaller capital-gains realizations. Soaking the rich doesn’t work when the rich aren’t making money in the financial markets. Outlays are up 11% so far this year, or $473 billion, and they would have been higher at $536 billion without the shifts in payment timing. Spending lowlights include $71 billion more for Mr. Biden’s latest student loan non-repayment plan; $111 billion more for Social Security, largely for cost-of-living adjustments for inflation; and $104 billion for Medicare from higher payments rates and more care … The biggest increase in outlays so far this year has been net interest on the soaring federal debt: a rise of $146 billion to $572 billion, or 34%. That interest total is nearly double all corporate tax revenue so far this year of $319 billion … Higher taxes will reduce the economic growth needed to finance all this spending. Few Presidents have had a worse fiscal record than Joe Biden.

The American Enterprise Institute analyzed various methods for determining the point at which government debt becomes unsustainable, and found that “The US, in particular, for one estimate, has a sustainable gross debt limit of 154% of GDP, which is only about 30 percentage points above its current gross debt level, projected to be reached by 2034.”

These developments led to a rare downgrading of U.S. debt by a major ratings agency. As the Wall Street Journal reported:

The decision by Fitch Ratings on Tuesday to downgrade U.S. debt has jolted Wall Street and Washington, but why is anyone surprised? The downgrade to AA+ from AAA may even be an overly optimistic assessment of the U.S. fiscal outlook, and it ought to be a warning to the political class, which will ignore it. “The rating downgrade of the United States reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to ‘AA’ and ‘AAA’ rated peers over the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions,” Fitch said in explaining its decision. The credit raters aren’t perfect oracles … But Fitch’s decision captures the unseriousness of America’s economic decision-making. For evidence, consider how much the U.S. fiscal and political outlook has deteriorated since the previous debt downgrade in 2011. Standard & Poor’s dropped its AAA rating on U.S. debt while Fitch and Moody’s didn’t. The ratio of U.S. debt held by the public to GDP at the time was only 65.5%, while the Congressional Budget Office expects it to be 98.2% this year. That’s up from 79.4% before the pandemic, and it is expected to rise to 115% of GDP by 2033 on present budget trend. As Fitch notes, U.S. “general government debt,” including state and local government, is more than two-and-a-half times greater than the median 39.6% of GDP for a AAA rating.

As Vince Kolber points out in the Wall Street Journal:

Washington’s spending has already reached a historic and troubling milestone. This news was hidden in the Treasury’s report for fiscal 2021, released last February. The issue arises from the way Treasury accounts for future spending that is required by law. It reports two separate figures, “net position” and “social insurance net expenditures,” but it doesn’t add them up into “total obligations,” and thereby deprives lawmakers and taxpayers of a full picture. Net position is the difference between U.S. government “assets” and “total liabilities.” Importantly, total liabilities include only bonded debt—that is, U.S. Treasury bills, notes and bonds. Total liabilities were $34.8 trillion at the end of fiscal 2021. The Treasury reported assets at $4.9 trillion. Simple arithmetic brings us to the net position, negative $29.9 trillion. But this accounting leaves a lot out. Social insurance net expenditures calculates the difference between the expected future liabilities of Social Security, Medicare, Medicaid and similar programs over the next 75 years and the income these programs are expected to generate during the same period under current law. The Treasury reported these unfunded liabilities at $71 trillion at the end of fiscal 2021. That brings us to the alarming milestone. Add the net position of $29.9 trillion to the social insurance net expenditures of $71 trillion, and you find that they topped $100 trillion—the first time they have ever done so. Government accounting specialists argue that the Treasury is right to keep these categories separate. They contend that social-insurance obligations aren’t truly debt because Congress has the power to curtail them by changing the law. But lawmakers have failed to do so for nearly 40 years and, until they do, the unfunded liability exists and is a present economic danger.

As Red Jahncke writes:

One school of thought asserts that so long as the economy is growing at a faster rate than the debt, the increase in the national debt doesn’t matter. But that certainly isn’t happening now. In principal amount, the national debt has exploded and the cost of debt service is escalating, too. The current $756 billion annual net interest expense on the $24 trillion of publicly held debt implies a required economic growth rate of more than 3% in a $25 trillion economy in order for the debt “not to matter.” The average forecast for economic growth in calendar year 2022 is less than 1% …

Researchers who run the Penn Wharton Budget Model reported in October, 2023 that:

We estimate that the U.S. debt held by the public cannot exceed about 200 percent of GDP even under today’s generally favorable market conditions... Under current policy, the United States has about 20 years for corrective action after which no amount of future tax increases or spending cuts could avoid the government defaulting on its debt whether explicitly or implicitly (i.e., debt monetization producing significant inflation). Unlike technical defaults where payments are merely delayed, this default would be much larger and would reverberate across the U.S. and world economies. This time frame is the “best case” scenario for the United States, under markets conditions where participants believe that corrective fiscal actions will happen ahead of time. If, instead, they started to believe otherwise, debt dynamics would make the time window for corrective action even shorter.

Accompanying this historic rise in federal debt are historic levels of federal benefits fraud. Early in 2023, the House Ways and Means Committee held a hearing titled “The Greatest Theft of Taxpayer Dollars: Unchecked Unemployment Fraud.” In his testimony at the hearing, the Inspector General of the U.S. Department of Labor, Larry Turner, stated that the new “low end” estimate for unemployment benefit misspending is $191 billion:

Estimating the overall improper payment rate for the pandemic UI programs is critical for the efficient operation of the program….In December 2021, consistent with our recommendation, ETA reported an improper payment rate of 18.71 percent for 2021, which ETA applied to two of the three key pandemic UI programs, PEUC and FPUC. Additionally, in December 2022, ETA reported an improper payment rate of 21.52 percent, which it also applied to PEUC and FPUC. We previously reported that, applying the 18.71 percent to an estimated $872.5 billion in federal pandemic UI funding, at least $163 billion in pandemic UI benefits could have been paid improperly, with a significant portion attributable to fraud. We are now able to report updated information, with two primary changes: (1) ETA released its annual improper payment rate estimate for fiscal year (FY) 2022 and (2) ETA has recently provided a total for pandemic UI spending. While that expenditure information is likely to be updated, we are now able to report on actual expenditures rather than on estimated funding. With those updates, more than $888 billion in total federal and state UI benefits were paid for benefit weeks during the pandemic period. Applying the estimated 21.52 percent improper payment rate to the approximate $888 billion in pandemic UI expenditures, at least $191 billion in pandemic UI payments could have been improper payments, with a significant portion attributable to fraud.

As Matt Weidinger reports:

On August 21, [2023] the US Department of Labor (DOL) released its long-awaited “improper payment report” on the troubled Pandemic Unemployment Assistance (PUA) program. PUA was an unprecedented federal unemployment benefit program that operated from early 2020 through September 2021. Prior reports from the DOL Inspector General and the Government Accountability Office suggested that PUA was subject to historic, but previously unconfirmed, levels of improper payments and fraud. The … key takeaway[] from DOL’s nine-page report: PUA had a staggering 35.9 percent improper payment rate.”

As the Wall Street Journal reports:

[T]his week [September 2023] the federal government more than doubled its estimate in stolen payments to as much as $135 billion. The new figure comes from a report released Tuesday by the Government Accountability Office (GAO). The finding is a rebuke to the Biden Administration, which had previously put the fraud total as low as $45 billion based on surveys of state programs. Congressional Republicans suspected the estimates were low and asked GAO to conduct its own study. The agency reached its estimate by assessing a sample of more than 2,500 unemployment insurance payments issued from 2020 to 2023. The Labor Department’s previous tally relied largely on adding confirmed fraud cases reported by states, but GAO auditors say that produced a massive undercount. The oversight agency assumed a higher, more plausible fraud rate by comparing unemployment insurance to similar federal programs. The $135 billion finding places the pandemic unemployment program in a new tier of government disaster. Fraud claimed 11% to 15% of the nearly $900 billion that Washington paid out over three years.

The fraud is so big that in my home state of Connecticut, the state announced the following in a recent press release:

Connecticut Department of Labor (CTDOL) Commissioner Danté Bartolomeo is warning Connecticut employers and residents of an uptick in unemployment benefits fraud ... During the pandemic, stolen identities were available on the dark web for about one dollar. Criminals are still mining this resource to purchase names, Social Security Numbers, birth dates, and other personal information that they use to apply for credit cards, bank loans, and unemployment benefits. Connecticut’s unemployment system is currently receiving several thousand claims per day; CTDOL suspects around 75% are fraudulent and is withholding payment.

In previous essays we explored how the official poverty rate is a very inaccurate means of determining true hardship, but even so, since President Johnson’s “War on Poverty” began in the 1960’s, even the official poverty rate has declined. But at the same time, dependence on government benefits was steadily increasing, even in the years leading up to the COVID pandemic. Researchers including those at the Federal Reserve recently found that:

We evaluate progress in the War on Poverty, as President Johnson defined it, which established a 20 percent baseline poverty rate and adopted an absolute standard. While the official poverty rate fell from 19.5 percent in 1963 to 10.5 percent in 2019, our absolute Full-income Poverty Measure, which uses fuller income measures and updates poverty thresholds only for inflation, fell from 19.5 to 1.6 percent … Additionally, government dependence increased over this time, with the share of working-age adults receiving under half their income from market sources more than doubling.

The COVID pandemic ushered in what has become a continuing cascade of federal benefits in the form of student loan forgiveness. As the Wall Street Journal described President Biden’s loan forgiveness scheme back in August, 2022:

Well, he did it. Waving his baronial wand, President Biden on Wednesday canceled student debt for some 40 million borrowers on no authority but his own. This is easily the worst domestic decision of his Presidency and makes chumps of Congress and every American who repaid loans or didn’t go to college … The government will cancel $10,000 for borrowers making less than $125,000 a year and $20,000 for those who received Pell grants. The Administration estimates that about 27 million will be eligible for up to $20,000 in forgiveness, and some 20 million will see their balances erased. But there’s much more. Mr. Biden is also extending loan forbearance for another four months even as unemployment among college grads is at a near record low 2% … Mr. Biden is also sweetening the income-based repayment plans that Barack Obama expanded by fiat. Borrowers currently pay only up to 10% of discretionary income each month and can discharge their remaining debt after 20 years (10 if they work in “public service”). Democrats said these plans would reduce defaults. They haven’t. Federal student debt has ballooned because many borrowers don’t make enough to cover interest and principal payments, so their balances expand. Student debt has nearly doubled since 2011 to $1.6 trillion, though the number of borrowers has increased by only 18%. Now Mr. Biden is cutting undergrad payments to a mere 5% of discretionary income … Worse than the cost is the moral hazard and awful precedent this sets. Those who will pay for this write-off are the tens of millions of Americans who didn’t go to college, or repaid their debt, or skimped and saved to pay for college, or chose lower-cost schools to avoid a debt trap. This is a college graduate bailout paid for by plumbers and FedEx drivers … Congress authorized none of Mr. Biden’s loan relief and appropriated no funds for it.

A year later, Nat Malkus wrote:

Yesterday I updated AEI’s Student Debt Forgiveness Tracker to incorporate new data from the Department of Education on Public Service Loan Forgiveness (PSLF) in April, May, and July. The tracker total now sits at an incredible $317 billion. With more forgiveness from current sources already in the works, and new sources of forgiveness planned by the Biden administration, there are three simple takeaways from this updated total. The first takeaway is that this $317 billion total is not some future prediction, it is the forgiveness that has already gone out. The tracker collects federal student debt forgiveness as it occurs, and tallies cumulating forgiveness over both the Trump and Biden administrations. This enormous total is hard to conceptualize, but it is more than a third of last year’s US military spending, and well over triple the amount the federal government spends on education … The second takeaway is that, despite what many might have assumed after Biden’s marquee forgiveness proposal was defeated at the Supreme Court, more forgiveness is in the works. The Biden administration announced last month that in the coming weeks, another $39 billion in forgiveness would come from a one-time Income Driven Repayment account adjustment … Hundreds of billions in expected forgiveness could come over the next 10 years from Biden’s proposed SAVE repayment plan, which substantially alters the terms of income driven repayment … The third takeaway is that we are at risk of becoming desensitized to these enormous forgiveness amounts. This week’s mid-month update came from updated forgiveness from PSLF. The average amount forgiven in the updated numbers was an astonishing $73,400 for nearly 170,000 borrowers.

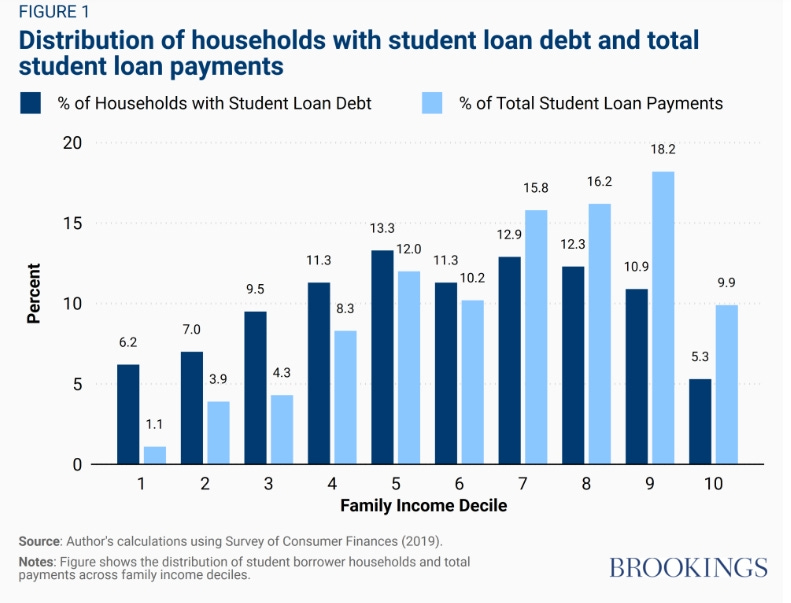

As Beth Akers writes, these student loan forgiveness policies have increased income inequality:

A new report from the Brookings Institution, a left-leaning think tank, and authored by University of Virginia Professor Sarah Turner explains that the pause on student loan repayment—which has now been going on for over three years, since the onset of the covid crisis—has benefited affluent borrowers the most. This isn’t a surprise to anyone familiar with the data on student loans, which shows that the largest debts are held by high earners. But it might come as a surprise to voters who were sold this plan as helping a group of economically-needy Americans. [In the below chart, the higher the decile, the wealthier the family.]

Despite this, and despite the Supreme Court’s striking down the Biden Administration’s first student loan forgiveness program, the Biden Administration has gone ahead with yet another student loan forgiveness program. The Budget Model used by the Penn Wharton Business School announced its evaluation of President Biden’s latest actions in July, 2023, as follows:

The Department of Education recently announced final regulations on the proposed Income-Driven Repayment Plan called “SAVE.” These final regulations follow the Supreme Court’s recent decision to invalidate President Biden’s previous Student Loan Forgiveness Plan. We estimate SAVE will incur a net cost of $475 billion over the 10-year budget window.

The student loan forgiveness program has even led many student loan borrowers to go even deeper in debt. As Alyssia Finley writes:

The Biden administration repeatedly extended the pandemic payment pause before announcing debt forgiveness of $10,000 to $20,000 per borrower last summer. The Supreme Court struck this down, but the administration’s Plan B will cap payments at 5% of discretionary income and forgive remaining balances after 20 years. Assuming this holds up in court, most borrowers will see their payments slashed by more than half, saving them thousands annually. Grads making less than $32,800 won’t have to pay a penny. This Plan B is another spending stimulus that will be underwritten by taxpayers on the installment plan—on top of the $200 billion that the pandemic pause has cost the government. Given this, you’d think that borrowers would have no trouble making payments again. The problem is that borrowers are now deeper in debt than before the pandemic. According to a recent TransUnion study, 53% of student-loan borrowers added bank credit card debt during the pandemic, while 36% took on new auto loans and 15% took out new mortgages. When student-loan payments restart, borrowers will have less liquidity to make these other debt payments—some of which carry higher interest rates ... Political leaders also cajoled many Americans into taking on more noneducation debt that they could afford because they didn’t have to repay student loans. A University of Chicago study found the payment pause had a large “stimulus effect” on the economy as borrowers substituted “increased private debt for paused public debt.” ... A JPMorgan data analysis in June likewise found that debt relative to income grew more for borrowers whose payments were paused than the broader population. Here’s the strange thing: Student-loan borrowers whose payments were paused were more likely to have higher incomes and subprime credit scores. While nonstudent-debt delinquencies during the payment pause fell for lower-income borrowers, they rose for higher-income ones. Among the top income quartile of borrowers—people making more than $94,425 and couples earning more than $188,850—delinquencies on nonstudent debt now exceed pre-pandemic rates by 25%.

It seems that without skin in the game, people are finding themselves fleeced.

We’ll take a break over Thanksgiving Day, but be back with new postings on Monday, November 27.

Reported deficits and Federal debt are one thing - but they don't reflect any of the actual or unfunded public debt accumulated by our states, local government or associated public agencies.

What's more, the Federal Government doesn't report any of the public subsidies it expends in the form of individual and corporate income and property tax credits and tax waivers. As the result, we have zero knowledge of concerning either the "current period expenses" associated with this activity nor the accumulated value of such credits.

This statement can be confirmed by ChatGPT for those who might wonder. Sadly, it seems, we have no means to demand this information from our government.

Paul, I would ask you to pick a non-depressing topic someday, but I have come to believe there are not any. The part of all this (whether schools, or government unions, or spending idiocy) that amazes me is why no one cares except the few of us that read your stack. Have a wonderful Thanksgiving -- I am really thankful for what you do.