In this essay we’ll explore Friedrich Hayek’s discussion regarding under what conditions might freedom coexist with a welfare state, as described in his book The Constitution of Liberty.

Hayek begins his discussion with two quotes, the first from Alexis de Tocqueville, the great nineteenth century French observer of American culture, who wrote in the second volume of his work Democracy in America:

Above this race of men stands an immense and tutelary power, which takes upon itself alone to secure their gratifications and to watch over their fate. That power is absolute, minute, regular, provident, and mild. It would be like the authority of a parent if, like that authority, its object was to prepare men for manhood; but it seeks, on the contrary, to keep them in perpetual childhood: it is well content that the people should rejoice, provided they think of nothing but rejoicing. For their happiness such a government willingly labors, but it chooses to be the sole agent and the only arbiter of that happiness; it provides for their security, foresees and supplies their necessities, facilitates their pleasures, manages their principal concerns, directs their industry, regulates the descent of property, and subdivides their inheritances; what remains, but to spare them all care of thinking and all the trouble of living?

Hayek then quotes American twentieth century Supreme Court Justice Louis Brandeis, as follows:

Experience should teach us to be most on our guard to protect liberty when the Government's purposes are beneficent. Men born to freedom are naturally alert to repel invasion of their liberty by evil- minded rulers. The greatest dangers to liberty lurk in insidious encroachment by men of zeal, well meaning but without understanding.

Hayek then describes how, at the time he was writing in the 1960’s, the intellectual class had reluctantly come to the conclusion that Soviet-style command of the economy was not going to work, and so they instead fell back on pushing forward with plans for an expansive welfare state:

Efforts toward social reform, for something like a century, have been inspired mainly by the ideals of socialism—during part of this period even in countries like the United States which never has had a socialist party of importance. Over the course of these hundred years socialism captured a large part of the intellectual leaders and came to be widely regarded as the ultimate goal toward which society was inevitably moving … During this period socialism had a fairly precise meaning and a definite program. The common aim of all socialist movements was the nationalization of the “means of production, distribution, and exchange,” so that all economic activity might be directed according to a comprehensive plan toward some ideal of social justice … [W]hat had happened in Russia was the necessary outcome of the systematic application of the traditional socialist program … [T]hough the characteristic methods of collectivist socialism have few defenders left in the West, its ultimate aims have lost little of their attraction. While the socialists no longer have a clear-cut plan as to how their goals are to be achieved, they still wish to manipulate the economy so that the distribution of incomes will be made to conform to their conception of social justice … [M]any of the old socialists have discovered that we have already drifted so far in the direction of a redistributive state that it now appears much easier to push further in that direction than to press for the somewhat discredited socialization of the means of production. They seem to have recognized that by increasing governmental control of what nominally remains private industry, they can more easily achieve that redistribution of incomes that had been the real aim of the more spectacular policy of expropriation.

Hayek then discusses the concept of a “welfare state”:

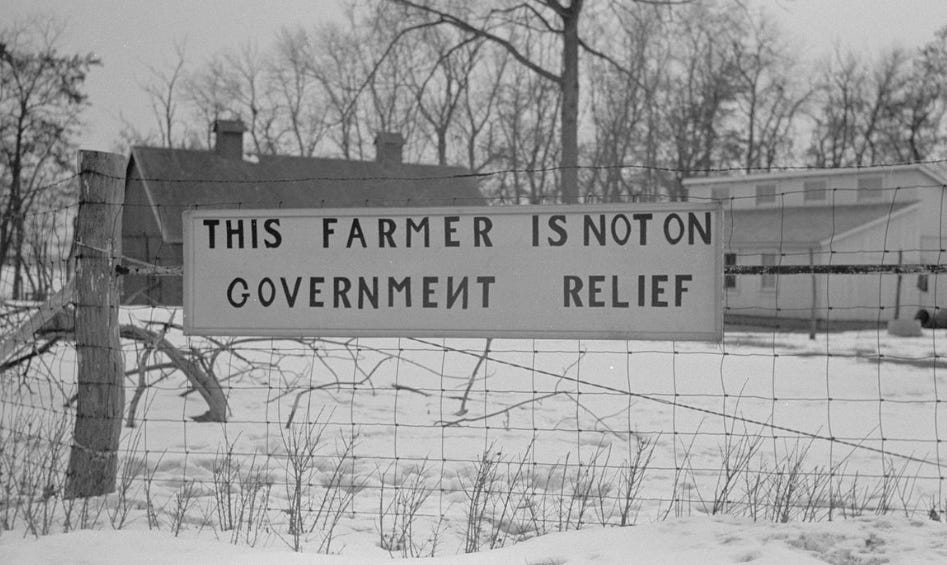

[T]he conception of the welfare state has no precise meaning. The phrase is sometimes used to describe any state that “concerns” itself in any manner with problems other than those of the maintenance of law and order … All modern governments have made provision for the indigent, unfortunate, and disabled and have concerned themselves with questions of health and the dissemination of knowledge. There is no reason why the volume of these pure service activities should not increase with the general growth of wealth. There are common needs that can be satisfied only by collective action and which can be thus provided for without restricting individual liberty. It can hardly be denied that, as we grow richer, that minimum of sustenance which the community has always provided for those not able to look after themselves, and which can be provided outside the market, will gradually rise, or that government may, usefully and without doing any harm, assist or even lead in such endeavors. There is little reason why the government should not also play some role, or even take the initiative, in such areas as social insurance and education, or temporarily subsidize certain experimental developments. Our problem here is not so much the aims as the methods of government action. Though the position that the state should have nothing to do with matters not related to the maintenance of law and order may seem logical so long as we think of the state solely as a coercive apparatus, we must recognize that, as a service agency, it may assist without harm in the achievement of desirable aims which perhaps could not be achieved otherwise. The reason why many of the new welfare activities of government are a threat to freedom, then, is that, though they are presented as mere service activities, they really constitute an exercise of the coercive powers of government and rest on its claiming exclusive rights in certain fields.

Hayek describes how the dangers of an ever-growing welfare state are more difficult to discern than the dangers of an explicitly command-and-control economic program:

The current situation has greatly altered the task of the defender of liberty and made it much more difficult. So long as the danger came from socialism of the frankly collectivist kind, it was possible to argue that the tenets of the socialists were simply false: that socialism would not achieve what the socialists wanted and that it would produce other consequences which they would not like. We cannot argue similarly against the welfare state, for this term does not designate a definite system. What goes under that name is a conglomerate of so many diverse and even contradictory elements that, while some of them may make a free society more attractive, others are incompatible with it or may at least constitute potential threats to its existence.

Hayek writes regarding “the desire to use the powers of government to insure a more even or more just distribution of goods,” that “Insofar as this means that the coercive powers of government are to be used to insure that particular people get particular things, it requires a kind of discrimination between, and an unequal treatment of, different people which is irreconcilable with a free society. This is the kind of welfare state that aims at “social justice” and becomes primarily a redistributor of income. It is bound to lead back to socialism and its coercive and essentially arbitrary methods.”

Hayek describes how the government’s provision of services lacks the private sector’s incentives for improvement:

In many fields persuasive arguments based on considerations of efficiency and economy can be advanced in favor of the state's taking sole charge of a particular service; but when the state does so, the result is usually not only that those advantages soon prove illusory but that the character of the services becomes entirely different from that which they would have had if they had been provided by competing agencies. If, instead of administering limited resources put under its control for a specific service, government uses its coercive powers to insure that men are given what some expert thinks they need; if people thus can no longer exercise any choice in some of the most important matters of their lives, such as health, employment, housing, and provision for old age, but must accept the decisions made for them by appointed authority on the basis of its evaluation of their need; if certain services become the exclusive domain of the state, and whole professions—be it medicine, education, or insurance—come to exist only as unitary bureaucratic hierarchies, it will no longer be competitive experimentation but solely the decisions of authority that will determine what men shall get … It is sheer illusion to think that when certain needs of the citizen have become the exclusive concern of a single bureaucratic machine, democratic control of that machine can then effectively guard the liberty of the citizen. So far as the preservation of personal liberty is concerned, the division of labor between a legislature which merely says that this or that should be done and an administrative apparatus which is given exclusive power to carry out these instructions is the most dangerous arrangement possible. All experience confirms what is “clear enough from American as well as from English experience, that the zeal of administrative agencies to achieve the immediate end they see before them leads them to see their function out of focus and to assume that constitutional limitations and guaranteed individual rights must give way before their zealous efforts to achieve what they see as a paramount purpose of government.” It would scarcely be an exaggeration to say that the greatest danger to liberty today comes from the men who are most needed and most powerful in modern government, namely, the efficient expert administrators exclusively concerned with what they regard as the public good.

Hayek then sets out what he sees as the priority areas for government reform, with the goal of maximizing freedom within a welfare state:

It is not [my] aim … to expound a complete program of economic policy for a free society. We shall be concerned mainly with those comparatively new aspirations whose place in a free society is still uncertain, concerning which our various positions are still floundering between extremes, and where the need for principles which will help us to sort out the good from the bad is most urgent. The problems we shall select are chiefly those which seem particularly important if we are to rescue some of the more modest and legitimate aims from the discredit which over- ambitious attempts may well bring to all actions of the welfare state. There are many parts of government activity which are of the highest importance for the preservation of a free society but which we cannot examine satisfactorily here.

One of the government activities less amenable to principled approaches is foreign relations. According to Hayek:

First of all, we shall have to leave aside the whole complex of problems which arise from international relations … The moral foundations for a rule of law on an international scale seem to be completely lacking still, and we should probably lose whatever advantages it brings within the nation if today we were to entrust any of the new powers of government to supra-national agencies. I will merely say that only makeshift solutions to problems of international relations seem possible so long as we have yet to learn how to limit the powers of all government effectively and how to divide these powers between the tiers of authority … I wish to add here my opinion that, until the protection of individual freedom is much more firmly secured than it is now, the creation of a world state probably would be a greater danger to the future of civilization than even war.

Hayek then turns to taxation:

Redistribution by progressive taxation has come to be almost universally accepted as just. Yet it would be disingenuous to avoid discussing this issue. Moreover, to do so would mean to ignore what seems to me not only the chief source of irresponsibility of democratic action but the crucial issue on which the whole character of future society will depend. Though it may require considerable effort to free one's self of what has become a dogmatic creed in this matter, it should become evident, once the issue has been clearly stated, that it is here that, more than elsewhere, policy has moved toward arbitrariness. It is clearly possible to bring about considerable redistribution under a system of proportional taxation. All that is necessary is to use a substantial part of the revenue to provide services which benefit mainly a particular class or to subsidize it directly. It was in Germany, then the leader in “social reform,” that the advocates of progressive taxation first overcame the resistance and its modern evolution began. In 1891, Prussia introduced a progressive income tax rising from 0.67 to 4 per cent. In vain did Rudolf von Geist, the venerable leader of the then recently consummated movement for the Rechtsstaat, protest in the Diet that this meant the abandonment of the fundamental principle of equality before the law, “of the most sacred principle of equality,” which provided the only barrier against encroachment on property. The very smallness of the burden involved in the new schemes made ineffective any attempt to oppose it as a matter of principle. Though some other Continental countries soon followed Prussia, it took nearly twenty years for the movement to reach the great Anglo-Saxon powers. It was only in 1910 and 1913 that Great Britain and the United States adopted graduated income taxes rising to the then spectacular figures of 8¼ and 7 per cent, respectively. Unlike proportionality, progression provides no principle which tells us what the relative burden of different persons ought to be. It is no more than a rejection of proportionality in favor of a discrimination against the wealthy without any criterion for limiting the extent of this discrimination. Because “there is no ideal rate of progression that can be demonstrated by formula,” it is only the newness of the principle that has prevented its being carried at once to punitive rates. But there is no reason why “a little more than before” should not always be represented as just and reasonable. It is no slur on democracy, no ignoble distrust of its wisdom, to maintain that, once it embarks upon such a policy, it is bound to go much further than originally intended. This is not to say that “free and representative government is a failure” or that it must lead to “a complete distrust in democratic government,” but that democracy has yet to learn that, in order to be just, it must be guided in its action by general principles … [P]rogressive taxation necessarily offends against what is probably the only universally recognized principle of economic justice, that of “equal pay for equal work.” If what each of two lawyers will be allowed to retain from his fees for conducting exactly the same kind of case as the other depends on his other earnings during the year—they will, in fact, often derive very different gains from similar efforts. A man who has worked very hard, or for some reason is in greater demand, may receive a much smaller reward for further effort than one who has been idle or less lucky. Indeed, the more the consumers value a man's services, the less worthwhile will it be for him to exert himself further … This effect on incentive, in the usual sense of the term, though important and frequently stressed, is by no means the most harmful effect of progressive taxation. Even here the objection is not so much that people may, as a result, not work as hard as they otherwise would, as it is that the change in the net remunerations for different activities will often divert their energies to activities where they are less useful than they might be. The fact that with progressive taxation the net remuneration for any service will vary with the time rate at which the earning accrues thus becomes a source not only of injustice but also of a misdirection of resources.

Finally, before we leave this discussion of The Constitution of Liberty, here are a few more quotes I found interesting in The Constitution of Liberty. This one regards education:

[T]hose who do not already possess [knowledge] often cannot recognize its usefulness … More important still, access to the sources of knowledge necessary for the working of modern society presupposes the command of certain techniques—above all, that of reading—which people must acquire before they can judge well for themselves what will be useful to them.

All the more tragic, then, that today’s educational establishment has botched reading instruction, as discussed in a previous essay.

And Hayek had this to say about what used to be sound education policy (but is much less practiced today):

That the United States would not have become such an effective “melting pot” and would probably have faced extremely difficult problems if it had not been for a deliberate policy of “Americanization” through the public school system seems fairly certain.

In the next essay series, we’ll begin exploring the arguments in favor of a system of free markets, using F.A. Hayek’s Road to Serfdom and Milton Friedman’s Free to Choose.

Paul, I have really been enjoying this series. I have learned more than I ever thought I would about this entire mountain of topics. You might capstone it with a practical piece on how these things do NOT coexist (especially when you try to tax at 5% perhaps the largest grift of all -- the remittances to foreign countries (where things are heavily taxed AFTER they get there). The California conflation of freedom restriction for citizens, freedom enhancement for illegals, a massive welfare apparatus where much money is shifted from the few remaining working folks and sent out of the country may show that these things cannot coexist. Seems like you asked a very topical question as your tag line on a particularly appropriate news day. In any case, thanks for this series. I shall now go take the bar...